There are several ways to earn passive income from real estate. You can earn passive income by renting property, house flipping or REITs. This article will discuss the basics of passive income through real estate. These tips can help you maximize your investment, even if your funds are limited. Find out more about passive revenue from real estate. In just a few easy steps you will be able achieve your real-estate goals.

Let me know if you are interested in renting a property

Renting out properties is a good way to make passive income from real property. To avoid potential problems, you need to carefully select tenants. However, these are just a few tips to help you generate the highest income. Additionally to carefully screening potential tenants, it is also important to be on the lookout for vacant homes. You may lose money, end up having to go through a lengthy process of eviction, or even be sued if you do not screen potential tenants.

Flipping houses

There are many sources of passive income that house flipping can bring you passive income. To generate income, fixer-uppers and foreclosure properties can be flipped. You can sell these homes as turnkey rental properties, or as fully renovated, fully rented homes. The property is available for rent and can be managed by the new owner. House flipping offers a great way to make passive income. The process is streamlined with technology.

Peer-to-peer lending

Passive income options for real estate investing are varied. For example, single-family homes can be more hands-off than apartment buildings. You will need to make the actual rental payments as well as manage and maintain the units. Storage facility investments can also be a passive source of income. These properties are in high demand across the United States. It is possible to generate passive income through leasing out your spaces.

REITs

Passive income from real property REITs can be a great way for investors to diversify their portfolios. These securities have low investment cost, with units as low $500. If you want to make income from real-estate, however, you should know that these REITs must share at least 90% of their income to shareholders. This will leave less money for reinvestment. This article will explain why passive income from REITs in real estate is such a great way.

Storage facilities

The self-service facility you own can help you generate passive income throughout the year. Some locations, such as Quebec, are seasonal but the demand for additional space is almost constant. You might have many customers throughout the year, depending on your location. Below are some revenue-generating ideas that storage facilities can use. Although some of these ideas will require you to put in a lot of effort and time, they will bring you steady income.

FAQ

What is the maximum number of times I can refinance my mortgage?

This depends on whether you are refinancing with another lender or using a mortgage broker. In either case, you can usually refinance once every five years.

What should you look out for when investing in real-estate?

The first step is to make sure you have enough money to buy real estate. You can borrow money from a bank or financial institution if you don't have enough money. It is also important to ensure that you do not get into debt. You may find yourself in defaulting on your loan.

Also, you need to be aware of how much you can invest in an investment property each month. This amount should include mortgage payments, taxes, insurance and maintenance costs.

Finally, you must ensure that the area where you want to buy an investment property is safe. It would be best if you lived elsewhere while looking at properties.

How do I fix my roof

Roofs can become leaky due to wear and tear, weather conditions, or improper maintenance. Repairs and replacements of minor nature can be made by roofing contractors. Get in touch with us to learn more.

What are some of the disadvantages of a fixed mortgage rate?

Fixed-rate mortgages tend to have higher initial costs than adjustable rate mortgages. You may also lose a lot if your house is sold before the term ends.

Should I rent or own a condo?

Renting might be an option if your condo is only for a brief period. Renting saves you money on maintenance fees and other monthly costs. However, purchasing a condo grants you ownership rights to the unit. The space can be used as you wish.

How can I calculate my interest rate

Interest rates change daily based on market conditions. The average interest rate over the past week was 4.39%. Multiply the length of the loan by the interest rate to calculate the interest rate. For example, if you finance $200,000 over 20 years at 5% per year, your interest rate is 0.05 x 20 1%, which equals ten basis points.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

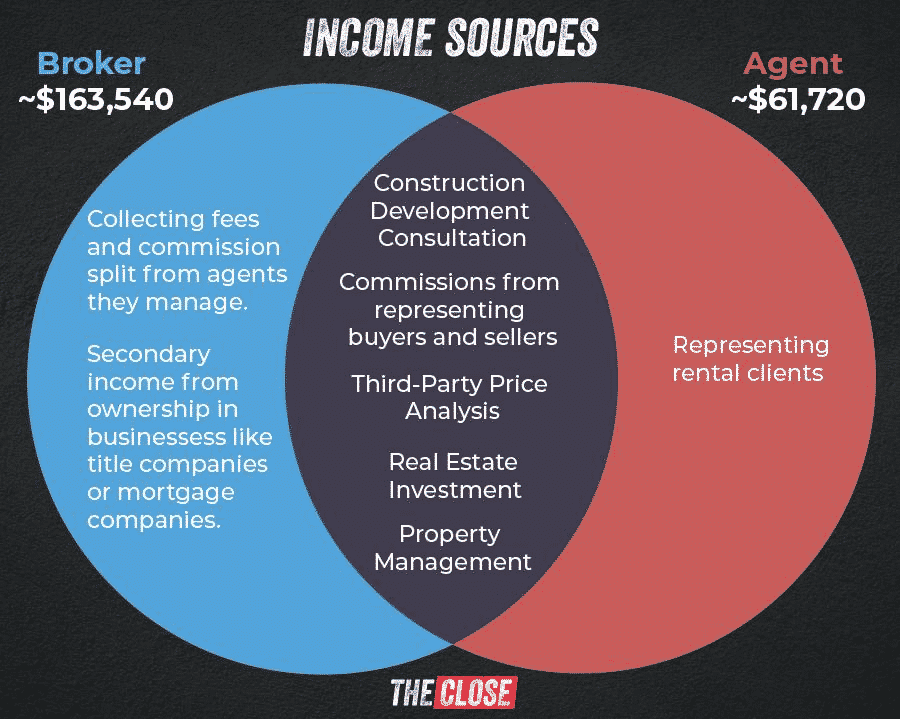

How to be a real-estate broker

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This involves studying for at least 2 hours per day over a period of 3 months.

Once you have passed the initial exam, you will be ready for the final. To be a licensed real estate agent, you must achieve a minimum score of 80%.

You are now eligible to work as a real-estate agent if you have passed all of these exams!