You need an agent if you plan on renting a property. The agent can help you find the right apartment or property, negotiate on your behalf with the landlord, and answer any questions that come up during the process.

Renting houses is a service that real estate agents charge. It usually takes a percentage of the total rent, but less than 15%. The commission is split equally between the brokerage as well as the agent. This should be arranged in writing before beginning to search for an apartment.

Renting agents are often able to advertise and show rentals, sometimes with flexible schedules. They can also manage the screening process and follow-ups with prospective tenants. They can assist in the creation of a lease agreement. This should include everything you need, including the length of your stay, the cost and payment schedule, as well as the property use rules.

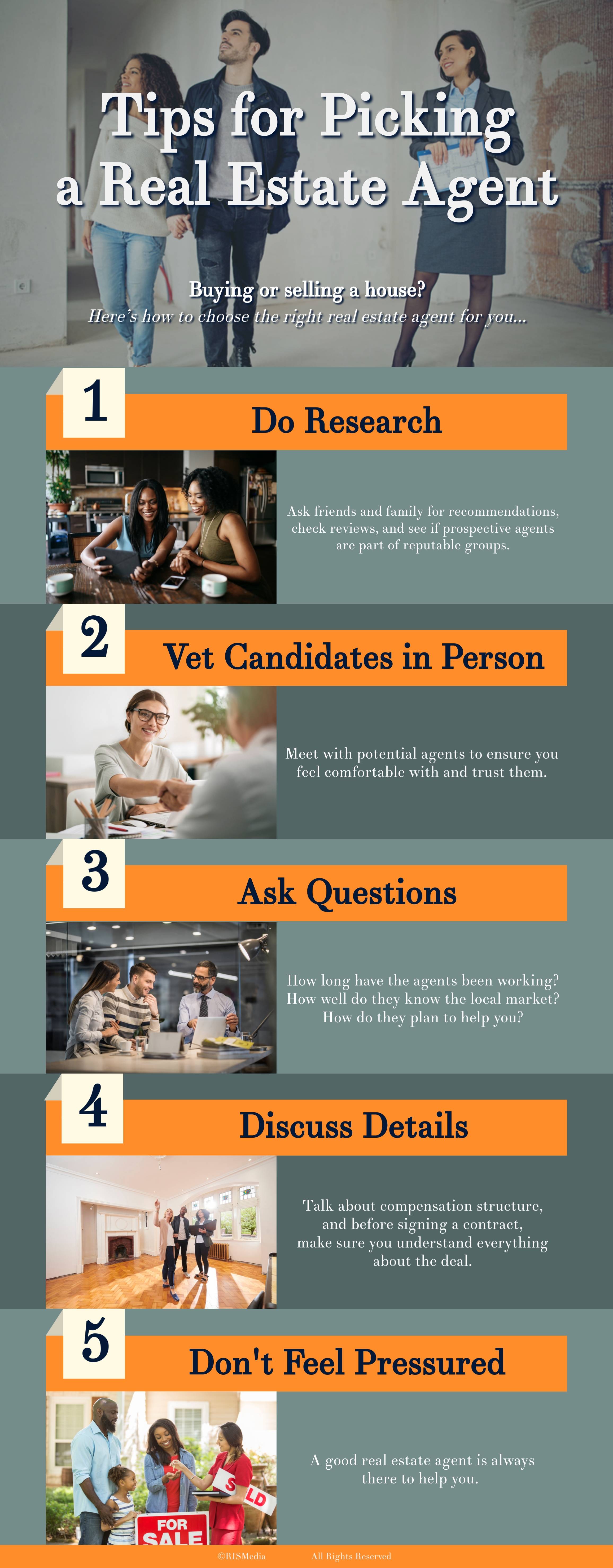

It is important that you find a property agent who has experience in managing rental apartments. They will know all the details of the market, which buildings are most popular with tenants, and can recommend the right places to you.

You can also ask your friends for recommendations of reliable real estate agents who are familiar with the local market. Perhaps they have worked with an agent who specializes in apartments. Or, they may know someone who does.

Online is a good place to start looking for an agent. Online real estate directories can be trusted to connect you with the right person for your apartment. FastExpert is one of the top options, as well as Zillow.

Finding a rental property can be tricky, especially if you're new to the area. A good rental agent will be able access a variety of resources including a database of apartments available and a network landlords who may be able offer you a better deal.

They can also help you target the right type of tenant and help you locate people who will pay the rent on time, clean the property, and make any necessary repairs.

Some agents also specialize in helping people find apartments for rent with a variety of specific requirements, such as rent control laws or tenants who are international or unable to meet U.S. credit or work history standards.

Hiring an agent has other benefits. Agent fees in some markets are tax-deductible. This can save you money long-term.

You can also get a tax deduction for the fees rental agents charge. They can also assist with drafting lease agreements that comply with all applicable state and local regulations.

FAQ

What are the benefits of a fixed-rate mortgage?

Fixed-rate mortgages guarantee that the interest rate will remain the same for the duration of the loan. This will ensure that there are no rising interest rates. Fixed-rate loan payments have lower interest rates because they are fixed for a certain term.

How can I tell if my house has value?

If your asking price is too low, it may be because you aren't pricing your home correctly. If your asking price is significantly below the market value, there might not be enough interest. Our free Home Value Report will provide you with information about current market conditions.

What are the three most important factors when buying a house?

Location, price and size are the three most important aspects to consider when purchasing any type of home. Location refers to where you want to live. Price refers to what you're willing to pay for the property. Size refers to the space that you need.

Do I require flood insurance?

Flood Insurance covers flood damage. Flood insurance can protect your belongings as well as your mortgage payments. Learn more about flood coverage here.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to purchase a mobile home

Mobile homes can be described as houses on wheels that are towed behind one or several vehicles. Mobile homes were popularized by soldiers who had lost the home they loved during World War II. People who want to live outside of the city are now using mobile homes. Mobile homes come in many styles and sizes. Some houses can be small and others large enough for multiple families. There are even some tiny ones designed just for pets!

There are two main types mobile homes. The first type of mobile home is manufactured in factories. Workers then assemble it piece by piece. This process takes place before delivery to the customer. A second option is to build your own mobile house. The first thing you need to do is decide on the size of your mobile home and whether or not it should have plumbing, electricity, or a kitchen stove. You will need to make sure you have the right materials for building the house. You will need permits to build your home.

If you plan to purchase a mobile home, there are three things you should keep in mind. A larger model with more floor space is better for those who don't have garage access. A larger living space is a good option if you plan to move in to your home immediately. The trailer's condition is another important consideration. Problems later could arise if any part of your frame is damaged.

You need to determine your financial capabilities before purchasing a mobile residence. It is crucial to compare prices between various models and manufacturers. It is important to inspect the condition of trailers. There are many financing options available from dealerships, but interest rates can vary depending on who you ask.

An alternative to buying a mobile residence is renting one. Renting allows you the opportunity to test drive a model before making a purchase. Renting isn't cheap. Renters typically pay $300 per month.