Brokerage fees are fees that brokers charge to represent their clients when they buy and sell a house, rent an apartment or secure a mortgage. Brokerage fees are usually based on either a flat rate or a percentage.

Brokers Commissions: What are they and what do they mean?

Real estate agents get paid commission for their work. It represents the value that real estate agents provide in the form of professional advice and expertise to their clients. It's usually a percent of the sales price, and it can be shared between multiple agents.

This type of commission can be seen in many other industries as well, such as in brokerage firms specializing in financial services. This can be a percentage or flat fee and is usually negotiated at the time a client signs an agreement to work with that agent.

What is an average broker's fee?

Brokerage fees vary widely depending on the asset type and size of investment. Brokerage fees are generally low for homes that are purchased by owners as their primary residence. These fees can, however, be significantly higher for investment property such as apartment blocks or retail centers.

What are the advantages of working with a Broker?

By helping you find a new house, a real estate broker can save both time and cash. They know the local market and can tell you how much you should expect to pay for different neighborhoods. You will be guided through the entire buying process from selecting a home that meets your requirements to closing.

What are some of the risks involved with using a brokerage?

Brokerage firms will provide insurance to cover their agents in the event they are sued due to negligence. Errors & Omissions can be covered by the insurance if an agent makes a mistake. It can cover legal expenses in the event a claim is filed against them.

Does the tenant have to pay a broker fee?

If you are looking for an apartment in New York City, it is important to understand the rules around broker fees. If you are looking for an apartment in New York City, it is important that you understand the rules around broker fees.

Is it against the law to charge renters for a broker's fee?

Broker fees have long been a hot topic in New York City's rental market. They are legal but the issue has been contentious for years. Both landlords and renters disagree on this practice. Several laws have been passed in an attempt to ban it.

It's always best to be aware of your options before you start looking for an apartment, and to do some research on the laws of your state. As a landlord, you should look for apartments that don't charge a brokerage fee and are regulated.

FAQ

How can you tell if your house is worth selling?

Your home may not be priced correctly if your asking price is too low. A home that is priced well below its market value may not attract enough buyers. For more information on current market conditions, download our Home Value Report.

How long does it take to get a mortgage approved?

It depends on many factors like credit score, income, type of loan, etc. It generally takes about 30 days to get your mortgage approved.

Is it cheaper to rent than to buy?

Renting is often cheaper than buying property. It's important to remember that you will need to cover additional costs such as utilities, repairs, maintenance, and insurance. There are many benefits to buying a home. For instance, you will have more control over your living situation.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

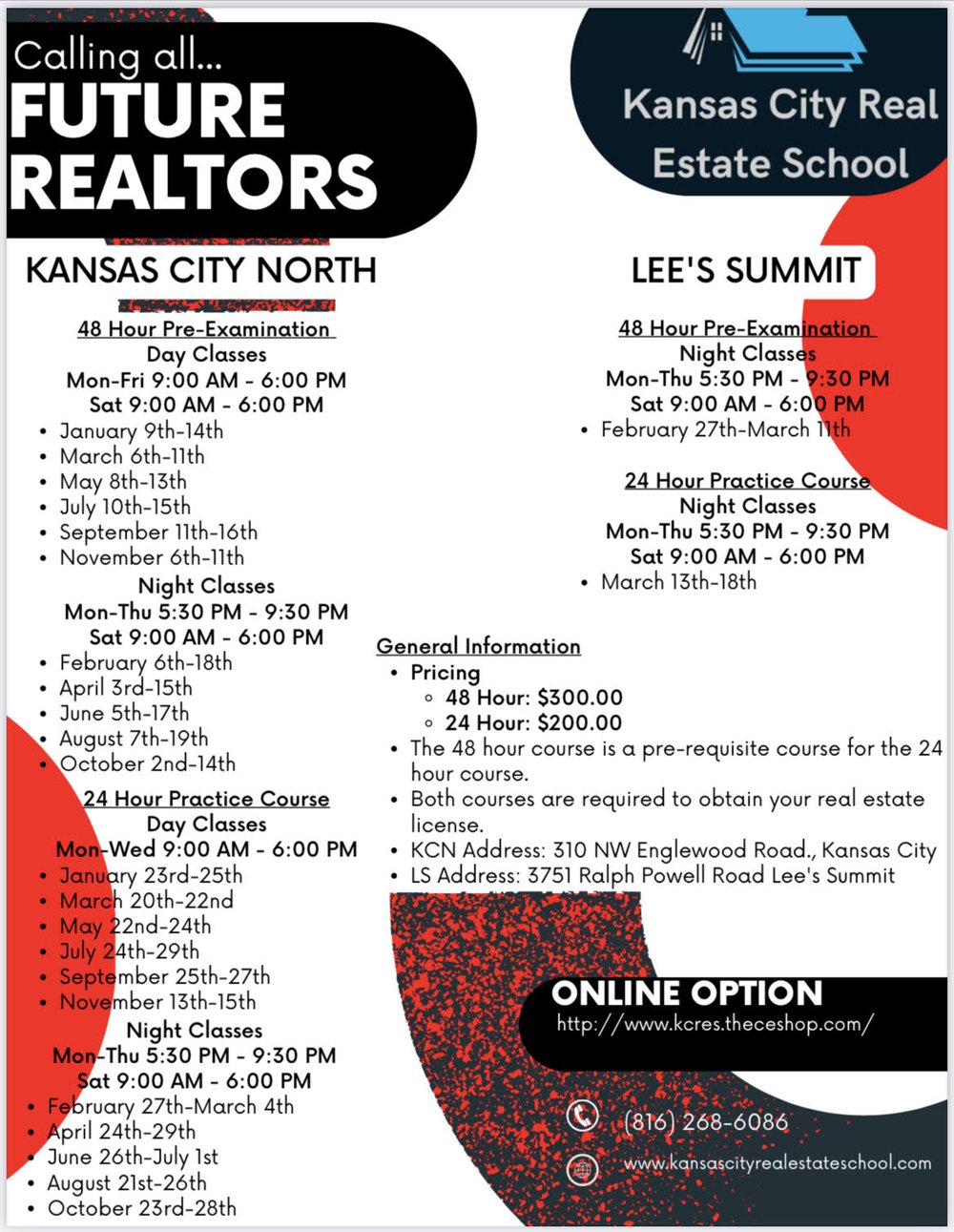

How to become a real estate broker

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

Next you must pass a qualifying exam to test your knowledge. This means that you will need to study at least 2 hours per week for 3 months.

This is the last step before you can take your final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

If you pass all these exams, then you are now qualified to start working as a real estate agent!